The US-China trade war is transforming global trade. Where it will go next depends on who will be in the White House.

The US has adopted a decidedly more protectionist trade policy since former president, Donald Trump, initiated a trade war with China (and beyond) in June 2018. Trade patterns between the US and rest of the world have already been transforming accordingly. China’s share of US imports has decreased from 22% to 14% with the decline more than offset by Mexico, the EU and Emerging Asia.

We expect this trend to continue under the next administration as both candidates, President Trump and Vice President Harris, also have a protectionist lean. But the more strategic, climate-oriented stance of VP Harris would lead to more investment and trade growth for US allies, whereas blanket tariffs under Trump would undermine global growth.

China and Mexico stand to lose the most under a Trump scenario compared to Harris. Emerging Asia on the other hand could possibly see economic benefits in the longer term due to the stronger trade diversion away from China, but potential second-round restrictions could prevent such gains.

Trump or Harris to chart the course

The upcoming US presidential election presents a critical juncture for the future of the country's trade policy and, in turn, world trade. In the 2016 election, Donald Trump championed a protectionist agenda that fundamentally reshaped US trade relations, especially with China. His administration’s sweeping tariffs, particularly on steel, aluminium, and Chinese imports, triggered trade conflicts that reverberated across the global economy. As the 2024 election approaches, the possibility of Trump's return, as well as Vice President Kamala Harris's potential ascension to the presidency, raises questions about the future direction of US trade policy.

Both candidates present distinct approaches to trade that reflect broader ideological divides within the country. Trump’s emphasis on economic nationalism and universal tariffs contrasts with the more cautious, though still protectionist, stance that Harris is expected to continue if elected. Each path has implications not only for the US economy but for global trade networks, especially in regions like Emerging Asia, Europe, and North America, where the ripple effects of US policy shifts are deeply felt. This report examines the current state of US trade, the legacy of recent trade actions under Trump and Biden, and the potential global impact of a Trump or Harris presidency.

Shifting winds in US trade policy

Over the last decade, US trade policy has evolved from a foundation of free trade agreements to one increasingly dominated by protectionist measures. This shift was motivated by the deepening geopolitical rivalry between the US and China. The Trump administration initiated the trade war to reduce dependency on Chinese imports, safeguard US technology and protect domestic industry. Tensions on the Chinese side were fanned by opposition to the US domination of the multilateral order, which it saw as undermining its economic ambitions and sovereignty.

The Trump administration instigated the trade war in 2018 when broad tariffs were imposed on Chinese imports, as well as on broad steel and aluminium imports, including those from the EU. Initially aimed at addressing the US-China trade imbalance and protecting American industries, these tariffs set the stage for a new era of trade tensions. While Trump’s protectionist measures triggered retaliatory tariffs from trading partners, they resonated well with a domestic audience concerned about job losses and declining industrial sectors.

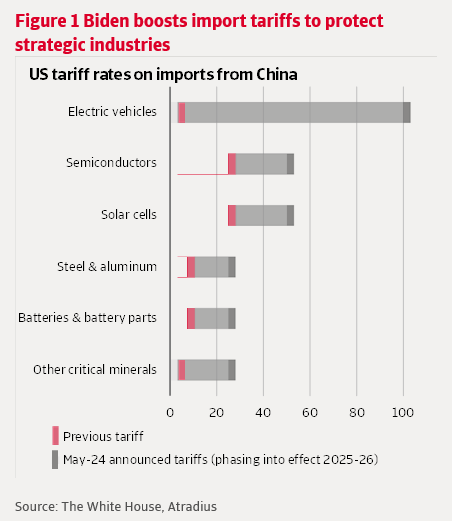

President Biden has accordingly continued this protectionist bent by not only maintaining Trump-era tariffs on China but expanding import restrictions. The continuation of nationalistic trade policy reflects broader concerns over national security and global competition. For example, the White House announced an increase in tariffs on selected Chinese goods considered central for national security and the green energy transition on 14 May 2024 (see figure 1). Biden has justified maintaining tariffs on Chinese imports as necessary to prevent market distortions and protect domestic industries, many of which have benefitted as well from unprecedented federal subsidies under his administration’s industrial policy, including the Inflation Reduction Act and the CHIPS and Science Act.

The Biden administration departs from Trump-style protectionism in its focus on increasing trade with friendly countries – known as ‘nearshoring’ or ‘friendshoring’. US trade policy has increasingly sought to achieve broader objectives over the past four years, including addressing climate change and ensuring supply chain resilience. One major example is the “Global Arrangement on Sustainable Steel and Aluminum”. This proposed trade arrangement between the US and the EU seeks to impose tariffs on metals produced in environmentally harmful ways, with an eye toward curbing China's dominant position in global steel production. Biden paused the tariffs on steel and aluminium imports from Europe since 2021 to allow for negotiations for this arrangement. Retaliatory tariffs from the EU on iconic American goods such as motorcycles and whiskey have in turn been put on hold, reflecting a more diplomatic approach to trade disputes.

Trade with China already caught in the doldrums

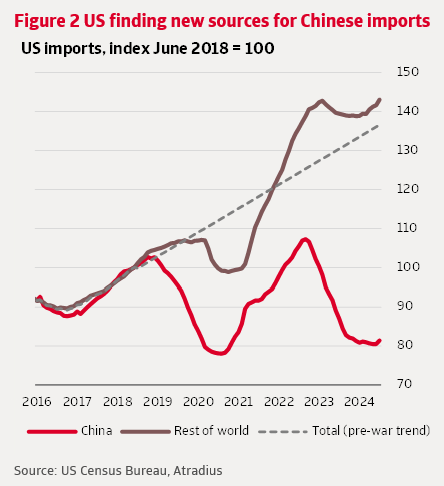

The remarkable shift in US trade policy, initiated by Trump and more or less continued by Biden, has had significant impacts on US and world trade, particularly trade between the US and China. Total US imports have increased 30% compared to the volume at the onset of the trade war under Trump, but that growth is 7ppt less than it would have been in the absence of the trade war (based on the January 2016-June 2018 trend). While some of that is certainly attributable to the effects of the pandemic on global trade, a deeper look into the composition of US imports shows clear impacts of US trade policy.

The trade war has reduced the volume of Chinese imports to the US to 80% of their June 2018 level (see figure 2). This level is roughly in line with the lowest level seen during the Trump administration – which was during the pandemic. China now accounts for just 14% of all US imports, compared to 22% before the trade war.

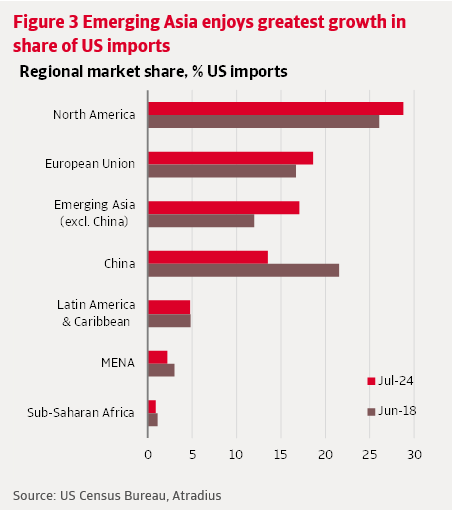

Imports from the rest of the world, on the other hand, are more than 40% higher than they were in June 2018. The level of non-Chinese imports even stands about 5% higher than they would have been in the absence of a trade war. The gap of Chinese imports has been filled by increases in imports from North America, the EU and Emerging Asia (excluding China) (see figure 3).

- North America maintains the largest share of US imports, increasing 3 percentage points (ppt) to 29% of total imports since June 2018. Mexico in particular accounts for 80% of that increase.

- Imports from the EU have increased 2ppt, now surpassing China’s market share. Imports in the chemicals and commodities industries have led the increasing market share.

- Emerging Asia excluding China has experienced the largest increase in US market share, rising 5.1ppt to 17% of total imports. The increase is driven by machinery and manufacturing. Vietnam stands out as the leader of this increase, followed by India.

This is in line with expectations as these imports are less impacted by US restrictions and come from countries broadly friendly with the US. But it’s also important to note that not all of this is due to increasing US demand: there’s also significant rerouting of Chinese exports to the US. For instance, Mexico and Vietnam have both seen their imports from China increase substantially since 2018 as their exports to the US increased.

Where will US trade policy go next?

How US trade develops going forward is highly reliant on the results of the November presidential election. The major shifts already observed in market shares of the world’s largest import market show that US trade policy has significant effects for the world. Taking into account the key trade policy priorities of President Trump and Vice President Harris, we estimate the effects for the global economy.

Donald Trump: aggressive protectionism

Former President Donald Trump is running on a platform that seeks to reinvigorate the aggressive protectionism of his first term. Central to his trade policy is the proposal for a 60% tariff on Chinese imports and a universal tariff, a sweeping measure that would impose a minimum 10% tariff on all imports to the US. This approach, which has been adopted as part of the Republican Party’s official policy agenda, aims to level the playing field for American workers and industries by rebalancing what Trump sees as unfair trade practices by US competitors, particularly China.

While China would continue to be the primary target, Trump’s universal tariff would affect all imports, creating potential disruptions across global supply chains. Such sweeping tariffs could stifle economic growth and lead to retaliatory measures from key trading partners and traditional allies – such as the EU and Southeast Asia. This would complicate efforts to address broader global challenges like climate change and security.

Nevertheless, Trump’s message resonates with voters who feel left behind by globalisation and free trade agreements. His promise to shield American workers from foreign competition remains a powerful tool in mobilising his political base, particularly in swing states such as Michigan and Pennsylvania where industries like manufacturing have faced significant challenges in recent decades.

Kamala Harris: environmental and labour rights accents

Vice President Kamala Harris is expected to carry forward much of the Biden administration's approach to trade while also infusing it with her own priorities. Although less vocal on trade during her vice presidency, Harris has consistently aligned herself with policies that emphasise environmental sustainability and labour rights. Her record as a senator reflects scepticism toward large-scale free-trade agreements, especially those that fail to address environmental and labour concerns. She was one of only ten senators to vote against the US-Mexico-Canada Agreement (USMCA) in 2020, citing inadequate provisions for addressing climate change.

The Biden-era Global Arrangement on Sustainable Steel and Aluminum offers an indication of how a President Harris would conduct US trade policy. By linking it with environmental standards, Harris is poised to push for more sustainable trade practices that align with her broader climate agenda.

Harris’s position on China remains firm, as she supports many of the Biden administration’s policies that aim to reduce dependence on Chinese supply chains. However, her focus would likely shift toward more targeted actions, such as promoting regional partnerships in Latin America and Asia to build alternative supply chains. Harris would also likely use trade as a tool to bolster labour rights globally, reflecting a longstanding Democratic priority that aligns with her domestic economic platform.

Headwinds on the horizon for the world economy

We expect the diversification of supply chains observed since 2018 to continue over the coming years regardless of the election outcome. Global companies have increasingly been seeking to de-risk their supply chains and this need will persist, underpinning a more structural shift. But how these shifting supply chains play out over the coming four years is very dependent on who will be in the White House. It’s evident that Trump’s brand of trade policy is more antagonistic to the rest of the world whereas Harris’s more strategic approach may produce more winners than losers. We make use of Oxford Economics’ Global Economic Model to measure the potential impact of a Trump versus Harris presidency.

The most important difference between the two scenarios in terms of trade policy is the imposition of a 60% tariff on Chinese goods imports and a 10% universal tariff on all other major trading partners that would be phased in over 2026 and 2027. As discussed above, we would expect trade partners to respond with retaliatory tariffs. In addition to the US tariffs, we impose on the model a 40% tariff from China on all US goods imports and 10% tariffs from other targeted trade partners. Under the Harris scenario, we maintain the current average tariffs. Following the above analysis demonstrating the significant increase in market share for US allies in North America (namely Mexico), the EU and Emerging Asia (Vietnam, India) we focus on the impact within these markets – in addition to the US itself and China.

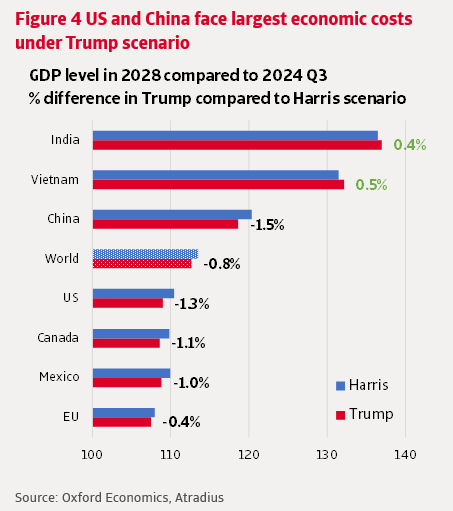

The escalation of US protectionism under a second Trump presidency would drag on global trade: the total volume of global goods exports would be 4% lower at the end of his potential second term in January 2029 compared to a Harris presidency. Lower demand for trade would be due to direct restrictions but also slower economic growth. World GDP would be 0.8% lower at the end of 2028 under the Trump scenario than the Harris scenario (see figure 4).

The US itself would see its economy consistently smaller in a Trump scenario as opposed to a Harris scenario. US exporters in particular would suffer as total goods exports would be 12% lower – far worse than any other country’s exports in this scenario – due to retaliatory tariffs on top of lower external demand. US imports from China would be replaced by higher imports from third countries, especially in Emerging Asia, as we’ve seen so far. Domestic output would also increase, especially in the US electronics markets. But the re-routing of trade and increase in domestic production would generally entail higher prices for US consumers: inflation would increase through a Trump term to 3% compared to 2% to 2.5% under Harris. Higher By the end of the presidential term, US GDP would be 1.3% lower.

Mexico would suffer the most severe consequences of a Trump re-election in the short term. Mexican GDP would be over 2% lower in 2026 than under a Harris administration, ending 1% lower in 2028. Uncertainty ahead of the renewal of the USMCA trade agreement in 2026 and the likelihood of Trump to use negotiations to leverage US interests at the expense of Mexico and Canada’s would undermine investor confidence in Mexico.

Mexico would be one of the main beneficiaries of a Harris administration. Real GDP would be 1% higher in 2028 under a Harris presidency than Trump, largely thanks to higher FDI inflows. Whereas FDI inflows to Mexico would flatline well below USD 30 billion per year under Trump, they could rise to over USD 31 billion in 2028 – more than USD 8 billion extra funds over the four-year term.

In the longer term, China would be the biggest loser under a second Trump presidency. The escalation of trade restrictions penalising China would likely shave off 1.5% of Chinese GDP in 2028 compared to a Harris scenario. Total Chinese goods exports would fall by 5.8% compared to today. Under a Harris administration on the other hand, total Chinese exports would still see growth of 2.7% per year over the coming four years, but this is still nearly half of the 4.9% average annual export growth observed since 2019.

While China’s economy would suffer the largest impact, some other economies in Emerging Asia could still eventually see benefits from a Trump presidency. Looking specifically to Vietnam, the economic consequences of a Trump administration as compared to a Harris administration is similar to that on the US economy in the short term: GDP would be almost 1% lower. Real exports would be 1% lower as external demand decreases. Especially linked value chains with China, lower demand for Chinese goods would drag on Vietnamese or other southeast Asian exporters supporting Chinese producers. But after the initial hit to growth, Vietnamese GDP would actually end up about 0.5% higher in the Trump scenario compared to Harris. Trade substitution and diversion away from China would eventually offset the hit to GDP growth. India would also see some 0.4% boost to growth for the same reason.

But there’s significant downside risk to these positive longer-run estimations: potential anti-dumping tariffs that are not included in the scenario modelling. Both Vietnam and India have among the largest trade surpluses with the US – a metric that President Trump often cites in motivating trade policy. And a Trump administration would be motivated to penalise imports from these markets to prevent the rerouting of Chinese exports. Therefore, there is an elevated risk that they could eventually be targeted for higher tariffs.

Dana Bodnar, economist

dana.bodnar@atradius.com

+31 20 553 6725

Documentele aferente

225.0KB PDF