Growing share of generics could affect local producers

Japanese pharmaceuticals producers are mainly doing business in the domestic market, with a rather low share of export sales. Large global companies and well-established domestic businesses dominate the Japanese market. The demand situation is good, and the backlog of non-Covid related medical care, spending and treatments has decreased since mid-2021, after the 'state of emergency' was lifted in major cities. At the height of the pandemic pharmacies suffered from deteriorating drug sales due to low footfall, while drugstores benefited from strong demand for sanitary goods.

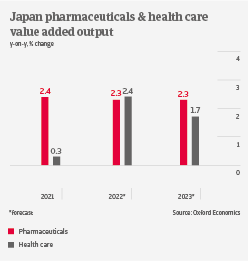

Japanese brand-name drug producers face annual rising R&D expenses, as the expiry of patents requires additional investment in the development of new medicines. Additionally, the yen depreciation has a negative impact. However, several Japanese pharmaceutical producers are in the final stages to get approval for Covid-19 vaccine production as of 2023, which supports their growth prospects. As Japan has a very high share of elderly population, demand for pharmaceuticals will increase in the coming years, in particular for special drugs to treat chronic diseases.

Despite good demand prospects there are challenges ahead, which could affect sales and margins of domestic producers and distributors in the mid-term. In order to curb public healthcare spending costs, the government revises drug prices biannually, and actively promotes the distribution of generics in the market. Currently generics sales amount to 47% in volume terms, but the government aims to increase this share to 80%. While more imports of generics would reduce healthcare costs, it would also dampen domestic drug production.

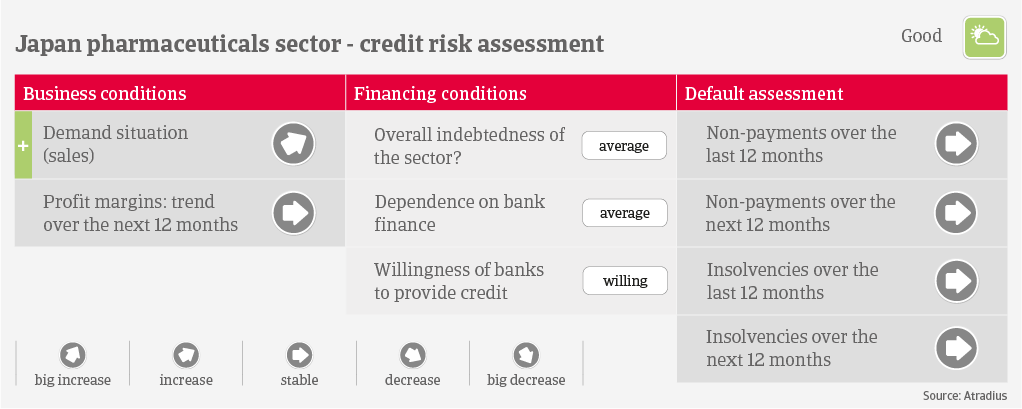

Most pharmaceutical businesses have strong balance sheets and good access to bank financing. The payment duration varies from 60-120 days, and payment behaviour has been very good over the past two years. The amount of both payment delays and insolvencies has been very low over the past 12 months, and we do not expect an increase in 2022. Due to the low credit risk and financial strength of most businesses, our underwriting stance remains open for the Japanese pharmaceuticals sector.

Documentele aferente

969.0KB PDF